The Decision to Demonetize: Event, Impact, Narrative, and Meaning

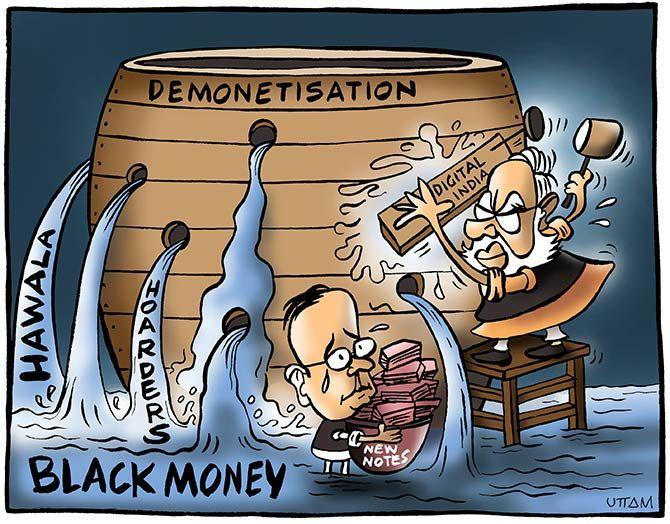

On November 8th, the government announced that the Rs. 500 and Rs. 1000 notes would no longer be legal tender. The original goals were to eliminate fake currency, inflict losses on those who have black money, and disrupt terror and criminal activities. Later, new goals were added, such as increasing bank credit and making India a cashless economy. According to a cost-benefit analysis, the benefits were relatively minor in comparison to the costs:

Expected impact on fake money:

A concentrate by the National Investigation Agency and the Indian Statistical Institute, in 2016, assessed that phony Indian money notes available for use have a presumptive worth of Rs. 400 crore. This is a frequency of phony cash of 0.022%. The size of duplicating of the Indian rupee isn't off the mark with what is seen in different nations, and the systems took on overall to address this incorporate analytical activity against forgers, staged substitution of old series of notes with new notes that have better security highlights, and so forth. De-adaptation is by and large not seen as an apparatus for managing to falsify. We should likewise not fail to remember that the forgers will presently get to chip away at the new 500/2000 rupee notes, while India will probably never do a de-adaptation from now on.

Impact on unaccounted wealth, also known as "black money," expected

The investigation introduced in the Finance Ministry's White Paper on Black Money, 2012, shows (on page 47) that, on a normal, how much money seized during strikes by duty specialists is 4.88 percent of all undisclosed pay conceded in those cases. This information is from more than 23 thousand warrants executed. Regardless of whether this choice incurred a 100 percent misfortune upon holders of unaccounted cash, this would suggest a deficiency of 4.88% of their complete unaccounted riches, which is a sad shock for those with such abundance. If, as is more probable, the demonetization has forced a 40% misfortune upon holders of unaccounted abundance (who experience a 40% markdown while laundering the cash), this infers a deficiency of around 2% of unaccounted riches.

Expected costs

Cash is a store of significant worth (white or dark), yet it is likewise a mechanism of trade. A great many people in India just execute with cash. Over 90% of shops acknowledge just money or extremely transient credit. A huge number of workers and little worth providers are paid in real money. While these realities might change over the long haul, they imply that this abrupt boycott might be prompting disturbances in utilization and creation. Contrasted with the 10,000 yen note (USD 137 in Purchasing Power Parity), the 1000 swiss franc note (USD 775), the USD 100 note, or the 500 Euro (USD 530) note, the Rs. 1000 (USD 31 in Purchasing Power Parity) and Rs 500 (USD 15.5) are down-to-earth takes notes that are utilized for exchanges. Subsequently, the de-adaptation of these notes is an enormous unfavorable financial shock, maybe the biggest at any point such shock in world history. The requirements of ATM recalibration and cash printing are prompting a long change period. In any event, guaranteeing 50% re-adaptation in real money structure, about Rs. 7.5 lakh crore, shows up hard by December-end. The Center for Monitoring of Indian Economy has assessed that a couple of components of the first-round influence give a decrease in GDP of around Rs. 1.3 lakh crore; the complete effect will be higher attributable to the multiplier impact, the hysteresis related to the financial shock, the effect upon assumptions, and so forth.

Who is responsible for the costs?

While there is a lot to discuss about the GDP effect of this choice, an interesting component of this episode is that there may extensive different costs that fall excessively upon poor people. The rich approach electronic installments, workers who will remain in lines to acquire money, and reserve funds that are utilized to adapt to a decrease in pay. The unfortunate come up short on these. Assuming destitute individual experiences a pay shock, or can't seek clinical treatment, the results are colossal for the individual, yet the GDP effect might be irrelevant. As far as government assistance suggestions, these costs matter significantly more than the effect on GDP.

Method for weighing benefits and costs

The advantages are essential as misfortunes incurred upon those with dark cash, while costs are forced on authentic financial and social exercises. Customary individuals, approaching their lives, have abruptly been approached to bear a weight-related with the undertaking of forcing costs upon individuals who have unaccounted abundance. A portion of the expenses is caused by needy individuals, whose government assistance misfortune may be significantly more for a given degree of Rupee cost brought about. Considering this distinction in the nature and frequency of advantages and expenses, before contrasting expenses and advantages, every rupee of cost ought to be given a lot higher load than every rupee of advantage.

It appears to be that the financial expenses of this choice are probably going to offset its monetary advantages. Some have contrasted this choice and a careful strike, however, it is more similar to an atomic strike. The atomic choice has been practiced before debilitating different choices. Even though actions to assist individuals with unveiling their undisclosed salaries have finished up, the endeavors to straightforwardly or in a roundabout way control wrongdoing have scarcely started. This raises worries about the insight of utilizing this switch of de-adaptation.

The established press account around the choice isn't generally so cynical as the examination introduced previously. There is a distinction between the standard account and the realities radiating from the beginning. In this article, I take a gander at the talk, investigate the contentions which are being introduced, and peer into the drawn-out results.

Four key contentions are being sent on the side of the choice:

- It is asserted that the choice is probably going to smallholder affect the poor than what many, for the most part episodic, reports propose.

- The money-related shock can be and will be, immediately defeat by the utilization of financial arrangement instruments to reestablish liquidity.

- This choice will facilitate the most common way of making India a "credit only economy", with benefits that will make transient expenses advantageous.

- Since the choice is well known, it should be great. This brings up a fascinating issue: in a majority rules government, might there be a superior proportion of integrity of an arrangement than its fame?

What difference does it make to the poor?

Two thoughts have been presented in the case that the unfriendly effect upon poor people will be little:

Cash investment funds as indicators of effect on poor people: Estimates because public studies show that cash profit of the poor is little, and they ordinarily need cash investment funds. In this way, it is contended, that they are probably going to only from time to time visit a bank office or mail center, and they are not especially troubled.

Credit as a mitigant of the effect on poor people: It has been contended that since the country's economy is altogether credit-driven, the effect on provincial unfortunate will be little. If executing parties know one another, they might want to broaden credit, which would make the present moment's non-accessibility of money less exorbitant. Given the practices in country markets, numerous business connections are without a doubt credit-driven, and cash calls are just made occasionally.

I dread that a more extensive comprehension of the monetary and financial existences of the unfortunate yields a comprehension of the effect of de-adaptation that is very unforgiving.

The monetary existences of unfortunate families are different from those of the working class and the wealthy in one urgent viewpoint - power and recurrence of monetary exchanges including cash. The proportion of monetary turnover to resources held, during a given period, is a lot higher for unfortunate families. Monetary turnover is the complete worth of every single monetary exchange, for example placing cash in or hauling cash out from any casual or formal monetary instrument.

Consider a working-class family with one salaried individual procuring Rs. 600,000 per year, with complete monetary ventures worth Rs. 10,00,000. From the financial balance, cash is removed and spent, drawn down through card/online installments, or moved into a venture instrument. If this individual has a Mastercard, each buy on the card would make two monetary exchanges of equivalent worth - drawing credit and reimbursing credit. Other than this, there may not be a lot of "move back and forth" in the individual's monetary life; just straightforward drawing down or contributing up. She may sometimes take credits or switch across speculation instruments. Monetary turnover during a year is probably going to be a lot slower than the complete worth of the monetary resources possessed. The money piece of the exchange worth might be more modest yet.

Research on the monetary existence of the poor was introduced in a milestone book, Portfolios of the Poor: How the World's Poor Live on 2 bucks every day, Collins et. al., 2009. It is observed that the proportion of all-out exchange worth to resources and incentives for unfortunate families is very huge. For the middle country unfortunate families in India, monetary turnover was multiple times the year-end resource esteem. This shows that even though, at a given time, an unfortunate family has just a little resource base and little investment funds, they are seriously executing. They are utilizing a scope of casual (for example credit to or from companions) and formal instruments (for example microfinance credits) - to place in and take out cash regularly.

For what reason do they do this? Most unfortunate families have little, sporadic and unusual salaries. This powers them to do high recurrence monetary exchanges to smooth their utilization. They are executing seriously during the time spent income the board, to change unpredictable pay streams into a steady progression of utilization from one day to another. At the point when the unfortunate wallow in this difficult exercise, they might go hungry. These are not the worries of the working class: their pay is considerably more steady, and they can involve their investment funds as a cradle. I dread that a large part of the editorial on de-adaptation comes up short on enthusiasm for this differentiation.

Here is a table, from the book, summing up a year in the monetary existence of a designer's family in Eastern Uttar Pradesh:

The numbers are in USD. The absolute exchange esteem is over multiple times the finish of-year worth of resources, and multiple times the finish of-year monetary total assets. Instruments have low end-period esteems, however, are seriously executed, as displayed in the "Turnover" section. For example, even though the credit balance is little, there is an enormous turnover, and that implies regular reimbursements. This family needs to do high recurrence cash-escalated exchanges just to make the timing of utilization match the planning of cash accessibility.

It is inappropriate to consider unfortunate families aggregating salaries and afterward going to a bank office to trade or store/pull out it. Most unfortunate families can't stand to do that, as their investment funds are little. They should effectively oversee salaries and utilization, utilizing high recurrence monetary exchanges. To the degree these exchanges included Rs.500 and Rs.1000 takes note of, the demonetization choice has briefly confined the capacity of unfortunate families to participate in their utilization smoothing.

The contention about credit connections remains constant for quite a while and specific settings. All needy individuals are purchasers, and many are likewise makers (eg. wage workers, craftsmen, and so forth). The vast majority of the credit connections of unfortunate families as shoppers are for the present moment, as proven by the high turnover in credit connections. Further, as makers, their capacity to chip away at credit is restricted by their little or non-existent investment funds. There are around 14.5 crore relaxed workers in India, who will be unable to deal with credit for a long time. As the remonetization is delayed, credit connections are going under pressure.

The facts confirm that credit is fundamental to the high recurrence of monetary exchanges among poor people. This doesn't intend that there is a profundity to adapt to a lot bigger prerequisites of credit on a supported premise. Moneylenders could detect issues of dissolvability, begin requesting deleveraging and interfere with credit access.

These inquiries, about the monetary exercises of poor people, should be found with regards to the enormous money-related shock which has turned into a huge pessimistic GDP shock. The unfortunate who fill in as easygoing workers, particularly in real money serious organizations, may see their business open doors evaporating. There are reports of casual work markets neglecting to produce work for some workers who depend on such business sectors. There is recounted proof about numerous little and medium scale businesses and building destinations briefly shutting down. Likewise, for ranchers, this is when yield is brought to the market and new planting is finished. Even though ranchers with little property as a rule don't have attractive excess, they need cash during the planting season. Landless workers might be impacted because ranchers with medium to huge landholdings can't get money to pay them for planting work.

India has a shadow economy. Numerous destitute individuals work in undertakings outside the authority, charge paying economy. A significant number of these endeavors are doing legitimate exercises without making good on charges. In this way, in that sense even though they are violating charge regulations, they are not criminal undertakings thusly. Consider a little block fabricating unit that is absolutely outside the assessment domain. The business is cash-escalated. It is accomplishing something unlawful - not covering charges. Nonetheless, it is a useful venture utilizing individuals. It is in the shadow economy and should be brought into the authority economy. This implies that it should be made to suffer assessments and consequences, however, it need not be closed down. The note boycott might have driven this money-concentrated endeavor into disappointment. The result is that the creation and business are lost, and nothing builds for the citizen. This isn't advantageous in any capacity and might be especially unsafe to destitute individuals working in such undertakings.

The poor are additionally more powerless against fakes and cheats that are flourishing in the current climate of colossal vulnerability. The unbanked are probably going to be essentially poor people, and the unforeseen prohibition on the trade of notes has caused a frantic circumstance for them. It is not difficult to say that they ought to open financial balances. However, in the current circumstance of vulnerability, we are hearing reports of individuals depending on frantic measures even to safeguard a piece of their investment funds. There are many reports of this occurrence in distant regions.

India is a huge, multi-landscape country, with a lopsided presence of banking offices, there are numerous locales with unfortunate admittance to banking offices. The exchange cost of making the trip to a bank office on various occasions to trade or pull out cash even once is very high at the level of a family's pay. We have heard tales about individuals living in distant towns in uneven regions depending on others to get notes traded, and taking misfortunes all the while. Along these lines, for a subset of the unfortunate living in distant areas, the expenses might be considerably bigger.

Almost certainly, the expenses of this choice on poor people will be huge, and a few destitute individuals could endure disproportionally. Unfortunate families have no dark cash and never really merited this.

Utilization of money related arrangement instruments to reestablish liquidity

A few reporters have contended that albeit the note boycott has made a shock to cash supply, the national bank could before long reestablish cash supply through the utilization of money-related arrangement instruments, for example, open market tasks, rate cuts, and so forth. It is contended that the Monetary Policy Committee will, in certain weeks, see the unfriendly shock to GDP, and vote for enormous cuts in loan costs, which will take care of the issue.

Notwithstanding, it is essential to remember the qualification between India's cash supply in banks and India's cash supply in real money. On 8 November, there were Rs.10.5 trillion of interest stores, and Rs.96 trillion in time stores, which are immeasurably more noteworthy qualities than the Rs.14.2 trillion of 500/1000 rupee notes which were disturbed. The electronic cash supply was not upset; it was the cold hard cash supply that was disturbed. This matters since cash is a favored vehicle of trade ("cash") for most exchanges. The imperative today is the deficiency of money. To beat the interruption, cash should be re-established under the control of individuals. None of the instruments of money-related arrangement do that. They just upgrade liquidity in the financial framework. Cash actually should be printed and apportioned through bank and postal organizations.

Credit only economy

An extra goal has been added: make India a credit-only economy. It ponders ineffectively the public authority's policymaking cycle to add such a major goal after starting the execution of such a pivotal choice. Assuming this was without a doubt a goal, much readiness ought to have gone in before the choice was declared. There is no proof of such an arrangement.

Cash is costly as a store of significant worth - it gives negative returns and is agreeable to misfortune and robbery. Numerous families are compelled to set aside money or other comparable resources since they don't have advantageous and solid admittance to the advanced monetary framework. It would be useful for some families and ventures to move a large portion of their store of significant worth to monetary instruments, yet provided that extensive solace around security, accommodation, and unwavering quality of these instruments is made.

The proof of the prevalence of electronic installments over cash as a mechanism of trade is restricted and set explicitly. There is proof to help make government-to-resident installments credit only, yet even there, the last mile issues of aiding the beneficiaries access and utilize this cash still can't seem to be tackled. A few exploration concentrates on showing the low quality of the last mile banking network in India.

For exchanges including just private gatherings, the case for going credit only for installments relies upon the specific circumstance. It would be great to have more cashlessness, however not in all circumstances, not for all people, and not for all reasons. Cash enjoys numerous inborn benefits, and in numerous unique circumstances, credit-only instruments are not better than cash. For instance, in a space with an unfortunate telecom network, cash is more advantageous. Individuals ought to have the opportunity to pick, contingent upon their unique circumstances.

This administration's push to make Indians go credit only seems to be an enormous, halfway arranged exertion in mission mode. This high pioneer approach is inappropriate for this goal. Going from money to credit only is an obscure and complex issue with muddled pathways. Putting away cash in monetary instruments and utilizing it to make everyday installments requires a standard, solid, and secure admittance to these instruments. This is certainly not a straightforward item that can be sent off the nation in the short term, however a refined help that is a necessity to consider the boundless assortment of requirements of families and undertakings. At its center, it is an individual decision that everyone ought to make time permitting. If this decision, and juvenile frameworks, are constrained down their throats, numerous people would draw back from electronic installments.

Government is innately awful at seeing the intricacy of such issues. It is probably going to release a gravely planned mission mode program, without understanding the bundle of administrations expected to make credit only store of significant worth and installments work. The program would likewise be hampered by the steady limit requirements of the Government of India. Whenever the goal is so perplexing, the public authority should be unobtrusive, and just assume an empowering part.

How most social orders have gone to less cash is through sluggish, cautious, itemized arrangement work. The ability to utilize pressure at the beginning phase of India's process is disturbing. For instance, consider shops tolerating card installments. There are around 1.5 crore retail shops, yet just around 14.6 lakh card gadgets. Should more shops acknowledge cards? Nobody can conclude this from the vantage purpose of arrangement making in Delhi or Mumbai. There is no ideal number of card-empowered shops. If obstacles are forestalling this, the administration and RBI ought to eliminate those hindrances. On the off chance that the right circumstances exist, and assuming the two buyers and businesspeople want to, this number will increment.

We in India have an important encounter from an episode that started in the mid-1990s - the dematerialization of offers. Assuming the government had constrained families to promptly turn all their portion testaments to Demat shares, many might have walked out on the offer market. They partook in the solace of holding those declarations and were don't know about the new framework. Since they were given a decision, throughout some undefined time frame, the greater part of them settled on demat shares. They saw the benefits and went with their decision. This occurred in a setting where the numbers were minuscule (the number of investors), however, it required around a decade. In that model, fortunately, the new framework turned out great. In any case, it might have neglected to convey. There were many dangers of things turning out badly. In such a circumstance, pressuring families to change to demat would have been unreasonable. Similar remains constant of the plan to go credit only, and at a lot bigger scope.

An ideal shift from money to electronic stores of significant worth and installments will occur assuming that empowering conditions are made, inside which individuals can pursue their decisions. The government's essential job in this progress ought to be to release contests and development while resolving issues through guidelines and complaint change. The government additionally plays a part in guaranteeing the arrangement of empowering framework, which incorporates Aadhaar, telecom organization, broadband organization, and so forth.

There is a colossal crisscross between assumption and reality on this issue. Certain individuals appear to accept that India could rapidly go credit only during this time of remonetization of money. This untimely utilization of compulsion, in an immature installment environment that has experienced significant mistakes of strategy for quite a long time, criticizes the approach interaction. It is dangerous to refer to this mind-boggling, long-haul yearning to lessen the utilization of money as some sort of mitigant for this unexpected note boycott.

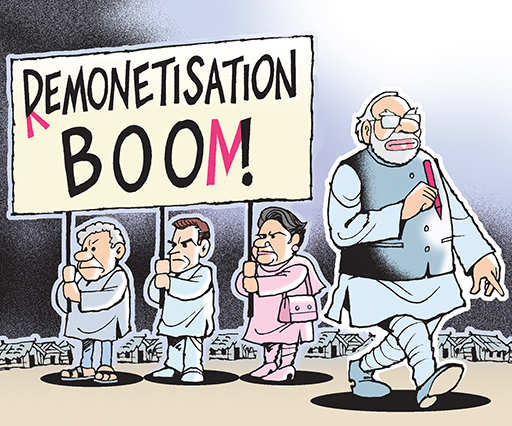

The fame of the choice

A few assessments of public sentiment show that the choice is well known. Think about the accompanying discussion:

Companion: I have heard that individual X in my area has kept a huge reserve of money. He is currently going around attempting to wash it. He generally paraded his not well-gotten riches, and it is great that he will experience a major misfortune.

Me: The information from charge assaults shows that around 5% of undisclosed pay is kept in a real money structure. Thus, this choice will just cause a little misfortune. Individual X is only one individual. The information I am alluding to comes from a huge number of assessment strikes. Regardless of whether Person X has an enormous reserve of money, it could be only a little level of the absolute dark cash he has. It does not merit making such a lot of disturbance to society at large, in request to make a little misfortune the unaccounted abundance.

Companion: Even assuming that is valid, to some degree this large number of degenerate individuals will lose their reserve of money. It will show them a thing or two. I'm willing to cause some bother for this. No less than somebody has effectively made the bad compensation. It will assist with lessening defilement. This is about the ethical norms of our general public.

Pondering this trade, I tracked down four significant contrasts in our points of view:

Factual versus Experiential norm

Public strategy experts like me principally depend on factual reasoning. My companion is utilizing an experiential norm. For an individual like me, the proof drawn from measurements overwhelms a couple of human interest stories, however, for some others, it is the opposite way around. Since dark cash and defilement are emotive issues that influence the overall population, the vast majority as of now have suppositions in light of individual experience or social impressions. Changing these opinions is difficult. My companion is available to a measurable viewpoint, however, maybe it wouldn't quickly adjust his view. The greater part of us people are instinctive - we structure an assessment rapidly, and afterward search because of motivations to help it.

We in the strategy examination world will generally fail to remember the oddity and the restricted utilization of the measurable viewpoint in the public eye. Measurements became arranged exclusively around the center of the eighteenth 100 years and were presented in school systems a lot later. For endless millennia, we have been framing sentiments about the world because of what we see in our nearby environmental elements. That is our normal impulse. On this specific inquiry, given the idea of data included (cash as the level of unaccounted abundance), experiential information on the people who don't bargain in dark cash might be misguided. Tragically, the media have made a lackluster display of putting out important data. The individuals who support the choice and the people who go against it are excessively depending on recounted proof. The narrative proof is helpful yet just to figure out the subtlety of explicit circumstances.

Total versus Nearby effect:

We contrast the size of our examination. While I am pondering the total compromise among advantages and expenses, my companion is checking out at influence on his nearby local area. Since he is a working-class proficient, the expenses for him and his local area might be little, while, in his view, the effect on Person X would be very enormous. Now and again, it is smarter to think of the neighborhood, and at different times, having a more extensive perspective is better. Defilement is an issue where figuring neighborhood could frequently be more sensible, given how it influences us, yet the bigger inquiry of upsetting dark cash stockpiling may be better tended to with a more extensive viewpoint.

Any activity versus Complex strategy projects:

We have various perspectives about how has been tackled the dark cash issue, and subsequently, our assumptions from the government additionally contrast. I'm utilized to the prolonged period scale over which strategy projects work out. For instance, the Public Debt Management Agency has been taking shape since the last part of the 1990s, and we are as yet a couple of years from seeing substantial outcomes.

As a trained professional, I value pawn moves inside a long technique, even though the pawn moves don't unmistakably convey anything in the short run. I would consequently be cheerful assuming the public authority fends breaking off on the front lines of defilement in the nation, and see no need of making such a problematic and costly move. My companion may not view it as such. He presumably questions the continuous moves, as it isn't obvious to him whether they are portions of a sound methodology or simply deferring strategies. He is glad to see unequivocal activity because, in his view, not much has occurred on this front. For my purposes, the decision is between careless activity versus cautious work inside a completely thought out technique; he considers it to be a decision between inaction and activity.

Authoritative choice versus Equitable fight:

We likewise vary on how we see this choice as an instrument of progress. My companion considers this to be a regulatory measure however he additionally considers it to be an honorable fight in the conflict against "the degenerate". I see it just as a managerial choice that ought to be assessed in unambiguous and quantifiable terms. I'm dissecting whether advantages are probably going to offset the expenses. My companion might concur with this examination, yet maybe he likewise sees this as an ethical battle that might incorporate a few lost fights, however, has an honorable goal.

These variables assist with making sense of why we in the scholarly world are confounded at why the demonetization choice was taken, however numerous others (remembering authors for the media) are very content with it.

While this is a depiction of conditions now, things will change over the long run and space. Many individuals who are not strategy experts are restricting the choice. A vital supposition behind my companion's help in the choice is that Person X, the "bad" individual, will endure. In a couple of months, many individuals like my companion might return to their perspectives, as they would see that not much difference in the frame of mind of Person X. This is powerful that is unfurling before us, and the adjustment of an individual's viewpoint about the choice would rely upon many variables:

The expenses and hardships endured by an individual and his precious ones. It's invigorating to chip in for an honorable reason for a couple of days, however as the costs move up, excitement might decline.

An individual's political alliance (we accept nearly anything on the off chance that we have a place with a group).

Whether one considers this an ethical campaign, which is to be upheld just because it was sent off, and not on its quantifiable achievement.

The degree to which one considers targets that were added as bits of hindsight (eg. making the economy cashless) to be pertinent, and the degree to which these goals are accomplished.

One's discernment about the government's general accomplishment on different fronts might come off on this.

The capacity of the political rivals to making solid other options, with the goal that there is a genuine impetus to apply mental assets in cautiously framing a judgment. Assuming there is just a single game in the town, we have a minimal motivating force to painstakingly pass judgment on the benefits and faults of each demonstration.

Judgment and Popularity

Should ubiquity matter? An unrefined cartoon of a liberal majority ruling government is one where all choices are made by individuals. This isn't the way the Republic of India, and every single delegate a majority rules government, are developed. In an agent a majority rules system, it is occupant upon chose pioneers to hear individuals' interests and afterward practice their judgment to pick an appropriate game-plan. State-run administrations stray from this obligation in two ways.

In some cases, states allude even complex choices to popular assessment. Noticeable ongoing models include the 2015 public mandate on the Greek obligation alleviation bundle and the Brexit choice.

Some of the time, states take choices that seem famous (read: upheld by a larger part of the residents), and use ubiquity as the main proportion of progress, without posing themselves relevant inquiries, for example, is the choice hurtful to certain residents? Might the choice at any point be hurtful over the long haul?

In a majority rules government, the desire of individuals ought to issue. Nonetheless, the whole apparatus of present-day conservative administration is intended to channel famous will through the exercise of good instinct. For what reason is this hardware required? In an exposition distributed in 1819, Benjamin Constant introduced a qualification between the freedom of people of yore and the freedom of moderns. For the residents of old republics (eg. old style Athens), freedom implied having a portion of the sovereign power.

This was an immediate majority rules system - residents needed to do many elements of government "on the whole however straightforwardly". They met up in the public square to examine and reconcile; frame partnerships with unfamiliar states; decide on new regulations; articulate decisions; assess the exhibition of the justices, etc. To do this, residents were supposed to commit significant time towards public and political issues, with the end goal that the singular residents and their private worries were less significant than public worries. Such support was costly. Social orders needed to rely upon captives to save the ideal opportunity for residents to perform municipal obligations, and the idea of private life was restricted. Additionally, just 10-20 percent of occupants had the honor and obligation of being residents.

Present-day freedom as practiced in current republics is altogether different. It is generally private, and it is delighted in by everybody in the country. It is basically about the evacuation of impediments and encumbrances that keep people from doing what they wish to do. It is an extension of the private circle. This freedom is made conceivable due to the arrangement of agent a majority rules system, wherein legislatures are chosen to oversee, and residents take part in legislative issues mostly through the instrument of casting a ballot, and through part-time city commitment during the intra-political race, periods to keep a mind the public authority. A microscopic piece of the general population takes part in legislative issues, and a much more modest number holds office. Residents choose; the chosen administrator; and the residents consider the chosen responsible for the results.

Government pioneers and their guides are accomplishing strategy work all day, while customary residents are carrying on with their private lives. Common residents don't have the information or an opportunity to pick the right arrangement, nor do they have the full data to pass judgment on the benefits of an intricate approach that has recently been declared.

In this specific circumstance, a direct majority rule government is appropriate for specific nearby issues where individuals can see the information sources and results. For mind-boggling, large-scale issues, officials and state-run administrations might look for general assessment (maybe through assessments of public sentiment), however, at that point, they should practice their judgment. Individuals requested an assault on dark cash, however, they didn't request demonetization as the weapon of decision. When asked, individuals appear to be saying that they support the move, maybe because they accept that it merits attempting, when different measures don't appear to have worked. Notwithstanding, pioneers are in the field and they should likewise hold their choices to other quantifiable norms of progress. Notoriety doesn't be guaranteed to verify the adequacy of an approach. It is for the pioneers to practice judgment in formulating the most affordable and best ways of going after the age and capacity of dark cash.

Retribution of expenses and advantages, communicated in rupees, is significant. Almost certainly, the demonetization choice bombs this test. Be that as it may, regardless of whether it breezes through the assessment of a cautious money-saving advantage examination, there are significant components of political reasoning which ought to be brought into the strategy talk:

Influence on privileges of individual residents

Influence on law and order and vulnerability in the general public

Influence on organizations

Influence on privileges of individual residents

One issue with a money-saving advantage approach is that, except if it is done cautiously, it can legitimize causing a lot of aggravation upon honest individuals just so society in the total can benefit. In any event, when done cautiously, it is as yet in light of the utilitarian presumption that up to a choice is gainful in the total, it tends to be defended. This total net advantage is an important condition for a choice, however, is it an adequate condition?

In an authoritarian framework, where the individual character is subsumed under the aggregate great, the total advantage is both a vital and adequate condition. Nonetheless, in a vote-based republic, individual privileges and obligations give the establishments on which majority rule self-government is laid out and supported. Common and financial freedoms should be protected, even in face of total cultural advantages. For instance, a needy individual may not contribute a lot to the GDP, however, is as yet a resident who has a piece of the constituent power that laid out the State in any case. Any thought of expenses and advantages should be far beyond the comprehension of the freedoms of people that can't be removed.

The choice to end the Rs. 500 and Rs. 1000 notes are destructive to the financial freedoms of residents. For quite a long time, their capacity to lead their monetary lives are seriously disturbed. Cash is of no utilization if one can't utilize it as needs be. By confining withdrawals from banks, which is a choice of sketchy lawfulness, and by restricting the trade of notes, individuals have been denied of utilizing their well-deserved cash when they need it. Due to the limitations, some might be compelled to take misfortunes even on their well-deserved cash. As my associate Anirudh Burman has contended, these are types of confiscation. The property right is a right under Article 300A of the Constitution of India, however, it's anything but a Fundamental Right. Nonetheless, interrupting the property privileges of residents is an awful arrangement, whether or not the Constitution of India precludes it or not.

The choice has prompted impressive issues for individuals who required cash for a crisis, for a pre-arranged get-together, or other authentic purposes. This is an offensive method for treating residents and possibly encroaches upon their different privileges. Their capacity to deal with their wellbeing, to get the nation over, to rehearse their calling, and so on, are impacted by this sudden choice. Large numbers of these effects are not completely caught in a basic money-saving advantage investigation.

Influence on law and order and vulnerability in the general public

The request is our key need, and vulnerability is the foe of the request. The choice to upset the vehicle of trade for such countless individuals, and afterward carrying out it in such a heedless manner, has created a tremendous vulnerability. This vulnerability that has been released could have capricious results, which ex-bet money-saving advantage examination can't consider. For instance, paranoid ideas and fakes are flourishing because of this huge scope interruption. Strategy choices ought to continuously attempt to limit vulnerability, particularly in choices executed at a large scale. This choice bombs this test.

Legislatures are supposed to set up a framework to lessen vulnerability and tackle the issues that make vulnerability. For instance, a fundamental emergency in the economy makes it vulnerable. At the point when Lehman Brothers fizzled and the worldwide monetary emergency started, the main assignment of the focal government and RBI was to decrease vulnerability and keep up with dependability in the monetary framework.

One of the fundamental approaches to diminishing vulnerability is to maintain law and order. Law and order is a mind-boggling thought, however, at its heart is sure to center standards. In the first place, regulations ought to be steady with regular privileges and standards of normal equity. Second, regulations ought to be clear, unsurprising, and well known in advance. Third, regulations ought to be applied consistently across comparable circumstances. Fourth, fair treatment ought to be followed, and that implies each use of regulation ought to give the private party data about the utilization of the law, the thinking behind the application, and a system for advance.

This choice has harmed law and order and expanded vulnerability. At the point when the government more than once vowed to permit the trade of notes till December-end, however suddenly prohibited such trade, the rule of consistency was disregarded. This didn't simply shock those with dark cash, yet it addition put others in trouble. The horde of administrators and incessant changes are putting a gigantic mental burden and harming the clearness of regulation. Hurting property privileges at such huge scope without appropriate examination, arraignment, and conviction isn't reliable with the fair treatment necessity. Causing hurt for the honest conflicts with regular equity.

The development of optional powers and domain of the expense specialists is likewise prone to debilitate law and order. The proclamations from the government strongly imply that being a free for all for the taxman is going. They will have the position to send notifications and begin examinations against any individual who might have stored cash. This has undermined a fundamental standard of policing: is free and clear as a matter of course. One manner by which this rule is placed practically speaking is by requiring a sensible weight of proof before the examination, before indictment, and, obviously, before sentencing somebody. The doubt fundamental to the note boycott choice turned everyone storing cash, which is typically a real movement, into an expected suspect.

We think back with objection at the License Permit Quota Raj. However, at times we fail to remember that the system of incalculable, incomprehensibly complex standards didn't come up in one day. The standard books continued to assemble fat over many years before they were focused on a huge fire in the mid-1990s. This standard expansion to rules was required by a mentality of doubt. There was an interminable wait-and-see game between the State and the resident because the State needed to control everything. Assuming the current pattern proceeds, a comparable game could be astir once more. This time it would be tied in with purifying the general public of all types of defilement.

Influence on organizations

Organizations are not only their structures, individuals, or legal powers. They are thoughts that exist in the personalities of individuals. The RBI has procured its validity for over 80 years, keeping a picture of an autonomous association that values respectability. There are reactions of RBI that it might have become a prisoner to its prosperity, and presently holds up traffic of India's advancement in macroeconomics and money. Be that as it may, its authenticity and honesty have never been addressed. Presently, a similar organization has been put in a truly challenging position.

The way this choice was introduced and is being executed, there is cause to think that institutional differentiations were disregarded, as simple conventions. The government's informing isn't helping the matter. Some in the public authority are crediting its initiative for the thought, while others are saying that it was RBI's thought. Correspondences pretty much all matters are concentrated at the Ministry of Finance, in any event, in regards to issues in RBI's ward. This episode is unsafe to the endeavors to depict RBI as an autonomous national bank. Add to this the dramatization around severely printed notes, flawed drafting of notices, and unfortunate interchanges from the national bank, and we might have the start of the finish of a foundation's validity.

After forty years, the capitulation of the legal executive during the Emergency poses a potential threat in our creative minds to that organization's capacity to safeguard our freedoms in our haziest hours. This note boycott episode takes steps to create a long shaded area upon the macroeconomic and monetary arrangement in India also. This episode shows the limits of legitimate assurances, for example, legal autonomy, employer stability under Article 311 of the Constitution, and so forth. The vaunted balanced governance gives off an impression of being deficient. The Constitutional plan of isolating power and vesting it in different establishments has been uncovered to have serious impediments practically speaking, particularly when a strong government focuses on following through with something.

Another drawn-out institutional effect of this choice would be found in the expansion of the draconian powers of expense specialists. The idea of the force of duty specialists is with the end goal that viability must be accomplished by a mind-boggling arrangement of responsibility. Augmenting income isn't the best goal, as it might prompt maltreatment of force. The new declarations imply that the expense division, particularly their authorization authorities, will be given unconditional power to pursue investors of money. Since this is a high need for government, they could decide in favor of abundance. Some might mishandle their powers for individual increases. The harm to the organization would be enduring, and it could require a long investment to re-establish a feeling of equilibrium and responsibility.

Nature of the bigger venture

The choice is amazing to such an extent that it has motivated idealistic or prophetically calamitous professions, contingent upon which side of the contention one is on. It has tested our earlier presumptions about the conceivable outcomes of policymaking in India. Is this the send-off of a terrific task? We don't have the foggiest idea, however, it would assist with thinking about the record of the person at the focal point of this choice - the PM. Given the PM's administration record and work style, it appears he ordinarily doesn't set out upon such adventurism. This choice is a break from his record. In contrast to Mao, Trotsky, Stalin, and others being conjured to make sense of what is happening, there was no foretelling for this choice.

The characterizations of this choice as a demonstration of domineering impropriety might be valuable as alerts, and, surprisingly, reasonable utilization of poetic exaggeration to evaluate a grievous choice, yet how would they charge as approximations of truth and as forecasts of what is to come? Here is one more perspective about this: might this choice at any point be only an illustration of disappointment in the policymaking system? The accompanying subordinate suspicions made the biggest difference in this choice:

the part of high group notes utilized for putting away dark cash, and

the speed of demonetization with new notes.

If a large portion of the notes are utilized to store dark cash, and on the off chance that the demonetization in real money should be possible in a week or fortnight, the choice would show up differently, though there would in any case areas of strength for being against it. The PM might have been prompted that not more than, say, Rs. 5-6 lakh crore, will return, and the leftover money is all dark cash, which will be challenging to launder assuming the public authority puts serious limitations on trades and withdrawals. Maybe the public authority under-assessed the job of money as a mechanism of trade, and as a store of genuine worth. They may likewise have over-assessed the speed at which demonetization in real money would occur. For a couple of days after the declaration, government pioneers said that demonetization would take only half a month.

This multitude of slip-ups may seem impossible, yet not assuming that you consider the tiny number of individuals associated with this choice, and the perspectives on specific people who guarantee to have prompted the public authority. Also, the historical backdrop of policymaking is packed with terrible choices when there was adequate proof to advise an alternate course. It is very conceivable that the cycle started with wrong suppositions, which were not remedied in time. This doesn't exonerate anybody of obligation, as the outcomes don't rely upon a unique goal.

On the off chance that the public authority without a doubt began with various suspicions, it should now be amazed by the Rs. 8.44 lakh crore (as of November 27th) that have previously returned, and the long timetables for demonetization in real money structure (till date, up to 18 percent done). Along these lines, the public authority is currently compelled to make do. Presentation of new goals (eg. go credit only), reneging on significant guarantees (eg. note trade), and multitudinous changes in timetables and rules are indications of ad-lib. It is managing the obscurity of a quickly unfurling circumstance in this immense, complex place where there is our own.

It is challenging to do significant impromptu creation since this arrangement choice doesn't take into consideration much adaptability. Since the choice is established on doubt, adaptability is thought to be "abused" to launder cash. The best way to truly reduce expenses was to move the choice back when advantages may be more modest and expenses may be bigger than anticipated. Be that as it may, moving back would make the public authority look awkward. Most pioneers would like to seem like a tyrant than to seem incompetent. They would prefer to be dreaded than be disparaged. Thus, spontaneous creation is by all accounts the main politically plausible choice. The sorts of things being done to ad-lib appear to be compounding the situation. This isn't to be expected, because state-run administrations are intrinsically bad at handling data rapidly and effectively, particularly in a quickly developing setting.

I don't imagine that the public authority expected to be hurt. In any case, what is important now is what it does from here on. Assuming the public authority without a doubt had various suppositions about how this will turn out, it might now be agreeably amazed that it has well-known help for the choice. For the present, this help is a wellspring of force. It is not yet clear if and how this help will change over the long run. Along these lines, the subsequent stages are very unsure. Has the public authority accidentally conceded to a high stakes idealistic venture to make a legitimate society out of us, and could consequently feel a sense of urgency to take all the more such "striking" steps? The amazing declarations about high pioneer dreams, for example, "credit only India", and idealistic aspirations, for example, "social upset" against debasement, recommend that the public authority might take that street loaded with tremendous dangers and hazy settlements. Or on the other hand, might the public authority at any point some way or another cautiously move down and return to an administration that is centered around getting the rudiments right?

This occasion has likewise uncovered an incredible arrangement about our scholarly people, our media, and, surprisingly, the more extensive common society. There is a lot to be thought about and gained from this workable second. The molding of the story is enlightening to watch. In my eyes, there is one exertion that has experienced significant harm: the work to construct another moderate development in India.

The vivacity around the 2014 political race introduced a chance to establish the groundwork for an alternate story of administration - one established on additional moderate standards. There is a continuous endeavor to assemble a local area for feeding moderate ideas to take on the scholarly and institutional authority of the alleged "left". This work is vital for India's political and social talk. The shortcomings of a balancing scholarly power might have prompted a specific stagnation in our political creative mind. The conceivable outcomes of governmental issues have not stayed up with the requirements of our general public.

If a moderate scholarly development extends its foundations and illuminates principled moderate governmental issues, in the resultant political stirring, there is a certified chance of alternate legislative issues to arise. Take the case of monetary issues. On these issues, our present political talk generally works in a post-1991 agreement. The agreement is basically about a steady opening up to private capital, however with the state proceeding to possess the instructing levels of the economy. It is a rendition of state-oversaw free enterprise, yet without a fit State. We additionally see disappointments of the State to get the fundamental assignments of administration right, while taking on incalculable conflicts for social and financial equity.

One reason for the shortcomings of the Indian state is the stuff it conveys from its communist past. As far as its state of mind, it is as yet a controlling, telling substance. It needs to control results across a wide scope of spaces. It experiences a typical revile of nations that were late modernizers: a staggering number and assortment of social and financial requests are put on it. Traditionalism has its abundance, yet on many issues, it could give a significant counter-view to conquer the current stagnation. It could, in addition to other things, assist with reclassifying the jobs of the State, the market, and the common society, and the interchange between them.

The note boycott choice and the account around it have accentuated the shortcoming of the Indian scholarly people. We don't have a minimum amount of individuals maintaining values, for example, assurance of property freedoms; who comprehend the requirement for the restricted government to safeguard common society and markets; who go against State-drove idealistic tasks.

Idealistic social designing ventures attempt to consummate human instinct. A moderate point of view would propose that human flaws can't be disposed of by diktat. The State can moderate the results of these flaws to a degree. The endeavors to beat imperfections of human instinct ought to be in the social space, not in that frame of mind of State power. Assuming the new Indian preservationists believe that extending state ability to seek after their #1 social and monetary goals is smart, they ought to see that a similar power would later be utilized for closes that they disagree with. This is a misstep that numerous on the left had made. Further, assuming they believe that property freedoms should be compromised at the special raised area of a venture to lessen dark cash, they might be feeling the loss of the forest for the trees.

Regardless of what the first expectation might have been, the note boycott choice matches or outperforms the most terrible overabundance of high innovator communism in India. It was anything but a moderate move. The choice takes steps to profoundly engage the public authority to bother and scare residents of the country. It harms property freedoms.

Unfortunately, rather than framing the vanguard of scholarly and social development, too many are deciding to be Praetorian gatekeepers for political power. This is innately awful for the drawn-out project, not because all compromises are terrible, but because compromising center standards are possibly pulverizing for a development that means to separate itself as far as its perspective.

End

The first suspicions hidden in the choice stay muddled, yet it is by all accounts hurting. This mischief is probably going to get us just a little mark on the dark cash issue and the disposal of two or three hundred crores of phony money. This is anything but a decent deal, particularly thinking about the drawn-out results. I don't know if the public authority planned this deal. In any case, right now, the choice is well known.

The government might have gotten itself into trouble with nobility. Since this choice appears to have evoked an emotional response from a bigger number of residents, political aspiration could entice the public authority to twofold down on this way, and take more "spectacular exhibition" choices. It would remove extensive diplomacy to go from this way of allurement full of tremendous dangers however sketchy advantages.

The public authority would do well to think about the disappointments of the policy-making system that prompted what has all the earmarks of being a terrible choice. If this was to be sure a certified misstep, and the government's suspicions ended up being incorrect, gambling with committing a greater amount of such error in a restless quest for grand goals would be impulsive. Our administration's ability to run complex projects is exceptionally restricted, and it is best exhausted on higher need issues, like structure of the law enforcement framework, accomplishing general well-being objectives, further developing learning results in essential schooling, assembling a dependable protection contraption, guaranteeing arrangement of sound foundation, guaranteeing clean air and water, etc.

Comments

Post a Comment